.png)

not featured

2021-04-05

Press Releases

published

.png)

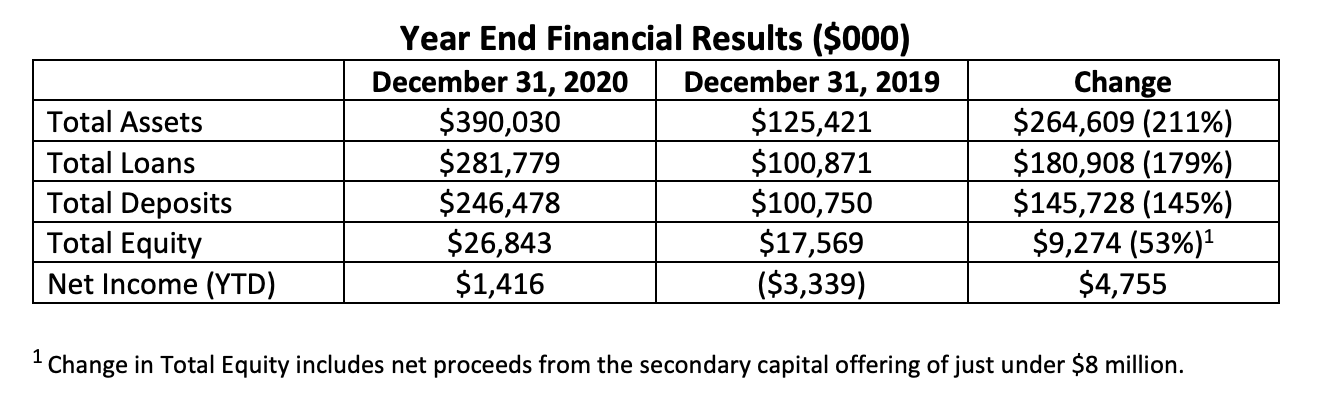

SAN DIEGO, California (April 5, 2021) –As of December 31, 2020, the Bank’s total assets equaled $390 million, reflecting substantial growth from December 31, 2019 of $265 million, or 211%

Loans and Deposits Exceed $281 million and $246 million, respectively, as PPP Loans Propel Growth Assets increase 211% year over year

SAN DIEGO, California (April 5, 2021) –As of December 31, 2020, the Bank’s total assets equaled $390 million, reflecting substantial growth from December 31, 2019 of $265 million, or 211%. Total deposits equaled $246 million as of December 31, 2020, reflecting growth of $146 million or 145% from yearend 2019, and total loans equaled $282 million at December 31, 2020, reflecting growth of $181 million or 179% from December 31, 2019. Between March and August of 2020, the Bank originated over 850 Paycheck Protection Program (PPP) loans totaling $175 million. At year end, total PPP loan balances equaled $118 million. The fees recognized from the origination of PPP loans significantly increased revenue, and ultimately enabled the Bank to achieve profitability.

For the full detailed financial statements covering the Bank’s operating results, please refer to the call report filed with the FDIC at https://www7.fdic.gov/idasp/advSearchLanding.asp (Enter Endeavor Bank name and click search).

Dan Yates, CEO, stated, “Participating in the Cares Act PPP lending program was one of the seminal events in our business careers. The Federal Government chose the banking system to deliver aid to working families and we are proud to have contributed. Endeavor extended over 850 PPP loans in record time to struggling businesses to help them make payroll, saving countless jobs. Ed Carpenter of Carpenter & Company, one of the nation’s leading banking consultants, stated that Endeavor Bank ranked in the top five banks nationally for delivering PPP aid in comparison to our asset size.”

Steve Sefton, President, added, “The PPP lending program was as beneficial to bank growth and earnings as it was in supporting employment. Endeavor achieved profitable operations up to a year ahead of schedule as a result of fees earned on PPP loans”.

Sefton also noted, “In addition to achieving profitability and outperforming expectations with respect to PPP participation, another important measure of success for a bank is credit quality. So far during these challenging times, Endeavor has managed to maintain credit quality in terms of past due loans, charge offs, and any other measurement of loan quality. Endeavor’s performance to date in this area is a testament to our sound credit process and business model, which requires our bankers to maintain a close relationship with clients to better consult and assist during times of financial crisis.

Yates further stated, “This is also a time to celebrate our success. Our growth and achievement of profitability is a tribute to our Board, our organizers, our shareholders, our professional team of highly skilled bankers, our business model, our dedication to our local business community, especially during a time of great need, but most of all, to the acceptance of our clients who have embraced and enjoyed our brand of consultative banking.”

The Board of Directors of the Bank has previously disclosed in both offering and proxy materials, that once the Bank is no longer considered a de novo institution by the appropriate regulatory authorities, it was the intention of the Board to grant nonqualified options to qualifying Bank organizers, including directors, to purchase the Bank’s common stock at an exercise price equal to the fair market value at the time of grant.

The Bank was no longer considered a de novo institution as of January 21, 2021. For this reason, in accordance with the Bank’s 2017 Equity Incentive Plan, on February 25, 2021, the Board granted 131,250 nonqualified options to certain organizers at an exercise price of $9.40 per share. The number of options granted to organizers (all of whom advanced seed capital and business assistance to start the bank) was determined by the Board in its discretion. In making that determination, the Board considered the amount of funds placed at risk by each organizer, the length of time such funds were placed at risk, and other factors deemed relevant by the Board.

About Endeavor

Bancorp Endeavor Bancorp, the holding company for Endeavor Bank, is primarily owned and operated by San Diegans for San Diego businesses and their owners. The bank’s focus is local: local decision‐making, local board, local founders, local owners, and relationships with local clients in the San Diego metropolitan marketplace and its surrounding areas.

Headquartered in downtown San Diego in the landmark Symphony Towers building, the Bank also operates a loan production and executive administration office in Carlsbad and La Mesa.

Endeavor Bank provides traditional business banking services across a broad spectrum of industries and specialties. Unique to the bank is its consultative banking approach that partners our business clients with Endeavor Bank’s senior management. Together, we build strategies and provide resources that solve problems, plan for the future, and help clients’ efforts to grow revenues and profits.

Visit www.bankendeavor.com for more information.

Forward-Looking Statements

This press release includes “forward-looking statements,” as such term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on the current beliefs of the Bank’s directors and executive officers (collectively, “Management”), as well as assumptions made by and information currently available to the Bank’s Management. All statements regarding the Bank’s business strategy and plans and objectives of Management of the Bank for future operations, are forward-looking statements. When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect” and “intend” and words or phrases of similar meaning, as they relate to the Bank or the Bank’s Management, are intended to identify forward-looking statements. Although the Bank believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from the Bank’s expectations (“cautionary statements”) are the effects of the COVID-19 pandemic and related government actions on the Bank and its customers, loan losses, changes in interest rates, loss of key personnel, lower lending limits and capital than competitors, regulatory restrictions and oversight of the Bank, the secure and effective implementation of technology, risks related to the local and national economy, the Bank's implementation of its business plans and management of growth, loan performance, interest rates, and regulatory matters, the effects of trade, monetary and fiscal policies, inflation, and changes in accounting policies and practices. Based upon changing conditions, if any one or more of these risks or uncertainties materialize, or if any underlying assumptions prove incorrect, actual results may vary materially from those described as anticipated, believed, estimated, expected, or intended. The Bank does not intend to update these forward-looking statements.